COVID-19 created widespread disruptions across the broader global supply chain that ultimately resulted in the headline impacts felt by consumers, from toilet paper shortages to soaring lumber prices. The pandemic also served to expose significant supply chain gaps, in addition to shining a bright light on the need for actionable real-time visibility into shipments. Over the past two years, companies building such visibility platforms have gained significant traction, unlocking new opportunities for industries like insurance. Partnering with such visibility platforms could provide insurers access to real-time driver behavior data and proactive risk management solutions for commercial auto liability. These partnerships create opportunities to launch other commercial products, such as cargo insurance, in a novel and differentiated manner.

Supply chains are complex

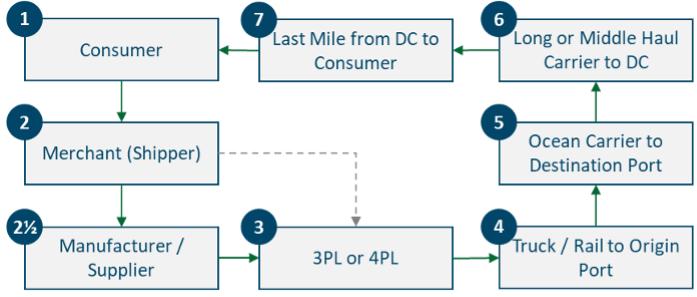

When consumers click the “Buy Now” button on Amazon, they expect the purchased item to arrive within two days on their doorstep. Unbeknownst to the consumer, the underlying supply chain infrastructure to fulfill a single e-commerce transaction involves many stakeholders and systems, often requiring complex, just-in-time coordination across transportation modalities and continents. We illustrate a basic view of the core stakeholders within the transaction flow below:

1. Order is placed and paid for by the consumer online.

2. The merchant (shipper) receives the order and begins processing.

2 ½. Instructions are sent to the manufacturer, often in Asia (note that manufacturing is a massive and complex ecosystem unto itself).

3. Simultaneously, the merchant may engage with third-party (3PL) or fourth-party (4PL) logistics providers to manage the shipment logistics.

4. The goods are delivered from the supplier via trucking carrier or rail to its origin port (or airport).

5. Goods are then loaded onto large container ships and delivered to their destination port.

6. Upon arrival at the destination ports, containers are moved via trucking carriers to regional distribution centers (DC).

7. Last-mile carriers and fleets deliver the goods from DCs to end consumers.

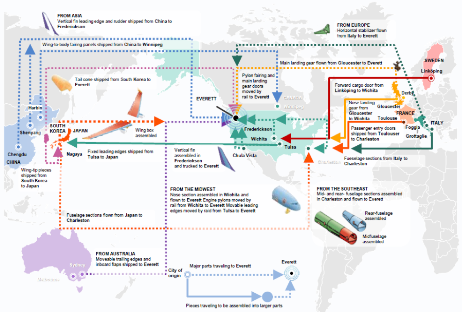

The above diagram reflects only a simplistic view of the supply chain and does not include complexities such as the multiple layers of sub-suppliers, the need to engage with several 3PLs or 4PLs as each is frequently specialized based on lane or region, nor the lack of pricing transparency in engaging with international carriers. The real-world reality can be seen in the sample Boeing supply chain diagram below:

The production of a single Boeing 787 Dreamliner requires engaging with more than 500 suppliers across ten countries to source, manufacture, and transport more than two million parts.

COVID-19 created widespread disruption and unearthed structural problems across the supply chain

The COVID-19 pandemic has created unprecedented challenges for the global supply chain, with shocks to demand (steep drops in physical purchasing followed by a rapid rise in e-commerce) and supply (dramatic labor shortages across large swaths of industries and manufacturing line closures). Each shock, in turn, created significant ripple effects that cascaded downstream to result in the headline impacts felt by consumers, from the toilet paper frenzy early in the pandemic to the months-long backorder on Peloton bikes today. While COVID-19 may ultimately represent a generational black swan event, it has highlighted significant gaps within the overall supply chain. For shippers, specifically, the necessity of actionable real-time visibility into shipments has become apparent.

The early onset of the pandemic brought substantial uncertainty across every geography, resulting in significant delays in freight movement. As 2020 progressed and e-commerce boomed, similar challenges were seen in ocean freight. Specifically, ports such as Long Beach and Los Angeles suffered substantial loading wait times of several weeks due to reduced capacity and staff shortages. Shippers were caught off-guard and could not take proactive actions due to a lack of real-time visibility into where shipments were. This ultimately led to downstream consequences, from workforce management issues to angry customers.

Before COVID-19, shippers had already found it challenging to maintain real-time visibility into their shipments worldwide because of the sheer number of stakeholders, technologies, and systems involved. In many cases, shippers would often rely on self-reported data from trucking and ocean carriers, which were riddled with errors and inaccuracies. Deliveries were often significantly delayed and stale by the time they reached shippers. Other shippers attempted to deploy IoT-driven solutions but lacked the critical technologies and platforms to manage thousands of devices at scale. The result was an inability to understand and act on events in real-time, leading to increased costs and more frequent delays.

Startups filling the gap and the opportunity for insurance

Increasingly, startups are beginning to fill the visibility void that has become apparent with COVID-19. Companies such as Project44, FourKites, and Avanta Ventures’ portfolio company Overhaul provide shippers with an end-to-end visibility solution leveraging a device-agnostic approach. By integrating with both internal systems (transportation management, warehouse management, enterprise resource planning, etc.) and external providers (electronic logging devices [ELDs] in trucks, onboard telematics, etc.), as well as ingesting a myriad of contextual data points, these companies are beginning to provide customers not only a real-time view of their global supply chain but also predictive analytics and recommendations.

Overhaul specifically goes one step further to automate the handling of exceptions and events in real-time. For example, in the event of a truck deviating off a set course, Overhaul’s platform would automatically notify all parties involved – including outreach to the driver and trucking carrier via integration with the onboard ELD and alerting the shipper’s supply chain teams. In addition, Overhaul has created integrations with local law enforcement systems via its Law Enforcement Connect (LE Connect) System and, in many geographies, has formed deep task force relationships with law enforcement agencies for recovery in the event of theft.

While supply chain visibility is the primary use case for such platforms, the aggregation of the stakeholder ecosystem and resulting data creates ripe opportunities for insurance innovation. The ability to integrate into the ELDs of trucks, for example, which are federally mandated on every truck in operation, could not only provide real-time driver behavior data for understanding risk, but also offer a unique avenue for reducing risk through proactive communications with the driver. Overhaul, for example, leverages its TruckShield platform and ELD integration to proactively warn truck drivers when they enter locations with high rates of collision and/or increased likelihoods of nuclear verdicts (jury awards that surpass $10M). In addition, such visibility platforms also have the potential of reducing cargo risk, such as loss and theft, by enabling the ability to actively monitor shipments in real-time.

About Avanta Ventures

As the venture capital arm of CSAA Insurance Group, Avanta Ventures invests deep industry expertise, resources, and investment in startups creating products and services that offer extraordinary value to the AAA Members of today — and those of tomorrow. As an affiliate of CSAA Insurance Group, Avanta Ventures is aligned with one of the top personal lines property and casualty insurance underwriters in the United States and part of the AAA ecosystem that serves over 53 million members.