COVID-19 has shaken the commercial insurance market as business interruption policyholders were angered by insurers rejecting pandemic-related claims. Parametric insurance that automatically triggers a payment when pre-defined event thresholds are exceeded offers a potential solution to this coverage gap and customer concerns. The benefits and appeal of this solution are driving forecasts for rapid parametric insurance market growth.

COVID-19 highlights gaps in traditional business interruption insurance

COVID-19 has created turmoil and disruption throughout the commercial insurance market. Many commercial business policyholders didn’t closely parse their policy terms at purchase and were later stunned to hear from their agents and carriers that they weren’t covered for business interruption stemming from the pandemic-driven economic shut down. Insurers assert that the government-mandated shutdowns constituted non-physical damage to the businesses and were therefore not covered by policy language. In some cases, policies explicitly excluded virus- or pandemic-related interruptions, prompted by the SARS and H1N1 scares of a few years ago. With COVID-19 we are seeing high-profile enterprises like the Houston Rockets NBA team sue their commercial insurer, seeking $400M in claim payoff, damages for breach of contract, and bad faith in claims handling. Small and Medium Enterprises (SMEs) as a class were especially irate that their business interruption coverage didn’t pay off. Political pressure on state government and regulators to mandate insurers pay claims not contractually covered has mounted. In response, legislation has been proposed in a handful of U.S. states that would require insurers to cover business interruption losses related to the coronavirus pandemic. In Congress, the draft Pandemic Risk Insurance Act would require insurers to cover business losses due to a pandemic, with the federal government serving as a backstop if their payouts exceed $250 million. There is also some precedent to reaching beyond the insurance policy for coverage in the Terrorism Risk Insurance Act, passed after 9/11.

Parametric insurance attracts customers with quick claims process and predetermined payout amount

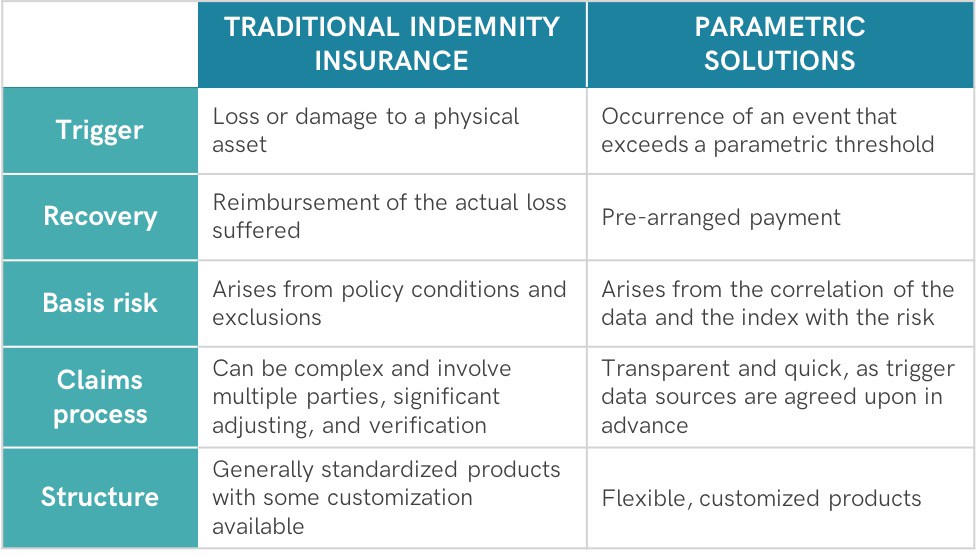

Instead of indemnifying for the actual loss incurred, parametric insurance covers the risk of a predefined event happening — a major hurricane, earthquake, fire, etc. — and pays out according to a pre-established scheme. Unlike traditional insurance payouts that are reliant on claims being fully adjusted prior to payout, parametric insurance uses the predefined parameters to provide customers with faster payouts and liquidity. Events may refer to an index-based trigger — a crop shortfall — or a specific event within a defined area — earthquake of a certain Richter scale magnitude. Insurer and insured agree ahead of time on the payout amount and the trigger data source, as well as any underlying calculations for that trigger. By addressing gaps in existing coverage — non-damage business interruption, normally excluded assets, loss of attraction and prevention costs — parametric insurance can complement rather than replace traditional indemnity products. It can also be used to cover deductibles in traditional insurance products. Offering the insurer instant claims settlement, reduced time and expenditure on loss adjustments, and avoidance of legal disputes. Parametric insurance also simplifies the loss investigation process and provides greater certainty of loss payment recovery compared to traditional insurance products.

It’s not all roses: Parametric insurance market headwinds

Although parametric insurance is an attractive product due to claims process simplicity and rapid payouts, several challenges have slowed its adoption. The first is lack of customer awareness. For example, MunichRe launched a parametric policy designed to provide business interruption insurance in the event of a pandemic in May of 2018, but no company purchased the policy prior to the advent of COVID-19.

Educating buyers on their existing coverage gaps and the risk management value proposition and key components of a parametric policy is a non-trivial task. Agencies and brokers need better education on how to assess where existing indemnity coverage has gaps, communicate to customers the risk management role parametric insurance can fill and where it may not cover the actual cost of a loss, as well as how to parse both the policy language and data sources used as the payout trigger.

Another challenge is how to predictively model and price the risk of payout. Data quality and risk correlation issues have been significant obstacles for many parametric insurers and reinsurers. In addition, the data sources used as payout triggers can have nuances in data quality, sensor uptime, or inherent biases that impact payout in unintended ways. Lastly, parametric policy re-insurers require better tools and models to analyze and price the risks they are reinsuring.

Startups tackling the parametric insurance space

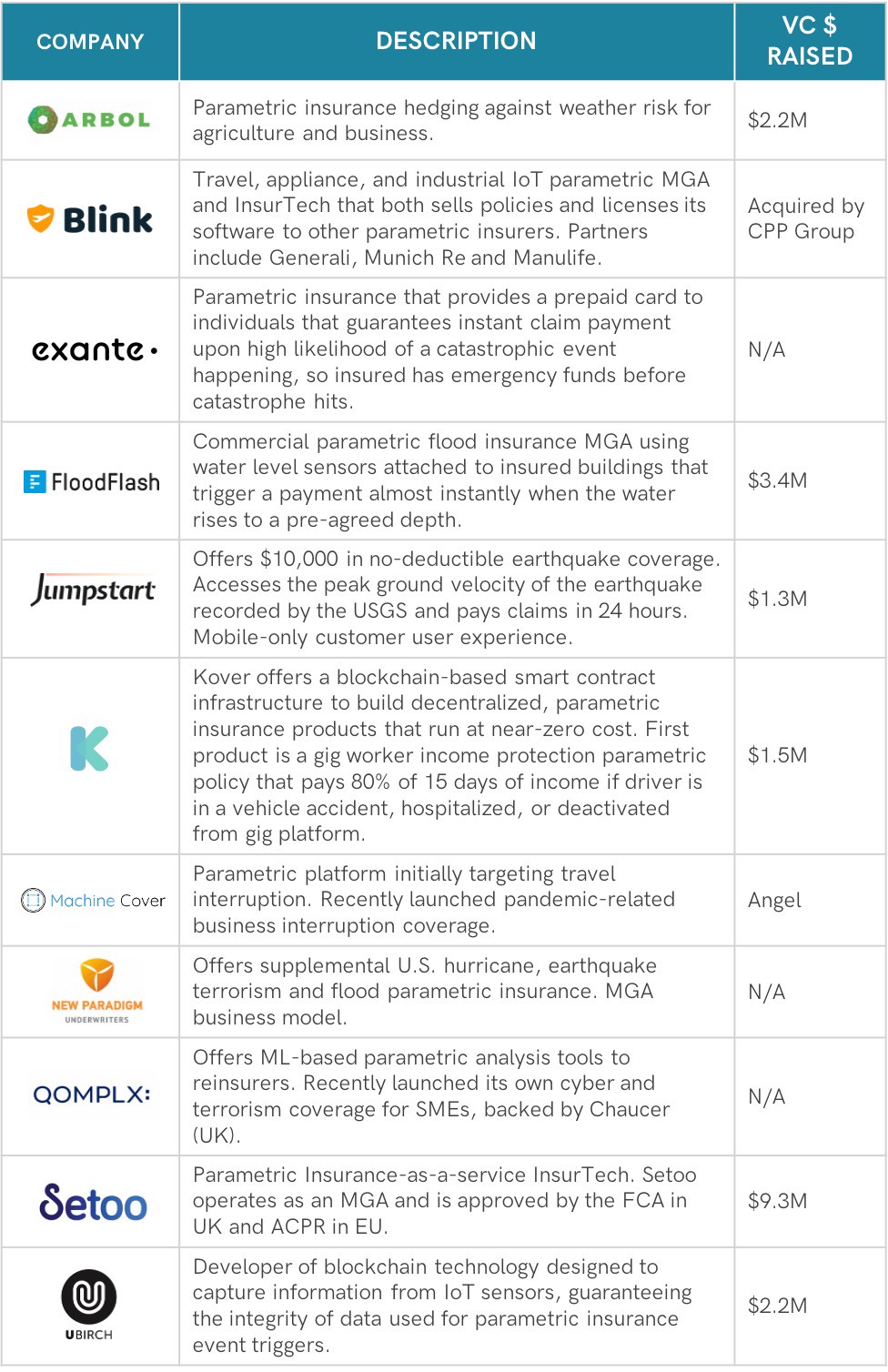

Although the challenges to parametric insurance adoption may seem daunting, startups are applying new technologies to solve them. VC-funded companies have begun to remove some of the complexities of parametric insurance products for SMEs, by defining simple objective triggers, thus relieving brokers of the educational burden. This resonates with SMEs seeking protection from wide-ranging business interruption perils — IT failure, data breach, terrorism and pandemics. New startups are delivering machine learning (ML) enabled parametric-specific risk analytics to insurers and reinsurers. IoT sensor networks are being built that provide the data for the parametric triggers in a reliable way and verified by third parties. Other startups are leveraging blockchain-powered smart contracts to speed the claims process even further, while offering trigger data auditability to the policyholder. Below are some of the venture-funded innovators hoping to drive growth of the parametric insurance market.

The long-term impact of parametric insurance

Parametric insurance represents a fundamental shift in thinking about insuring intangible or non-physical losses. COVID-19 has driven business and consumer awareness of the limitations of indemnity products and the advantages of parametric insurance. From pandemics to natural catastrophes, cyberattacks, and terrorism, parametric insurance represents an opportunity for businesses to better control unexpected risk exposures.

While to date parametric insurance has been primarily growing in the commercial insurance space, we expect the demand for this type of coverage to become more mainstream and potentially find its way into the personal-lines insurance markets as well. Whether automatic payouts to help customers cover emergency out-of-pocket expenses, or AI-driven property damage reporting, the opportunities for parametric insurance to have an impact on consumer policies are plentiful. Startups will continue to apply data analytics, machine learning, and blockchain-enabled smart contract innovation to this space, expanding the range of available alternative risk transfer options across markets.

We are certainly just beginning to see the game-changing ways parametric solutions are impacting the insurance industry and businesses, but there is so much more opportunity to be better prepared for the next unexpected event.