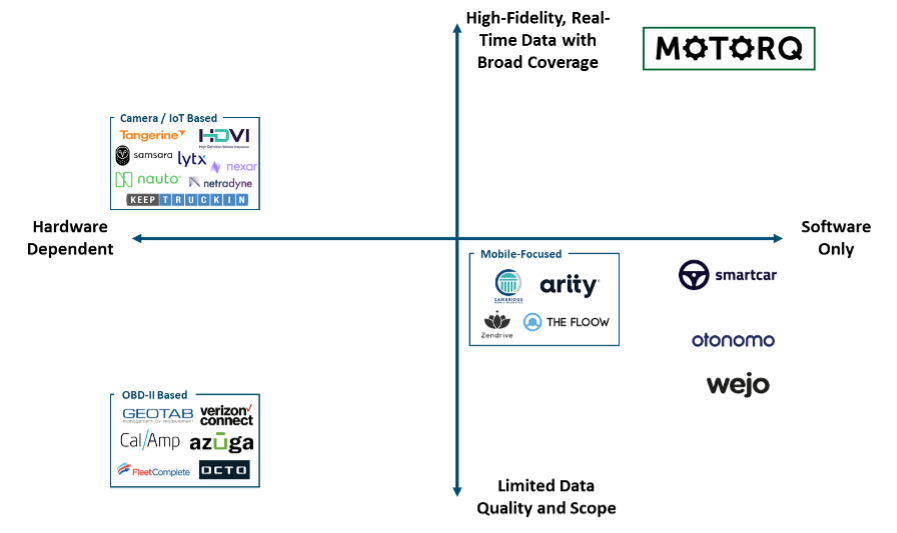

The vehicle telematics industry has experienced substantial change and growth since its beginnings in the 1980s with the development and regulatory mandate of the onboard diagnostic (OBD) port. Over the past decade, telematics has migrated toward both a use-case-centric model and smartphone-first solutions. Within insurance, for example, Cambridge Mobile Telematics (CMT) and Arity are both mobile-first platforms that capture driving data and correlate the dataset with losses to produce risk scoring for customers. Despite their benefits, both OBD-connected devices and smartphone-based solutions have significant drawbacks, including data-quality issues, limited access capabilities, and deployment frictions, leading to a minimal 10-15% telematics adoption by fleet vehicles. Connected-vehicle data, however, is poised to solve many of these challenges and represents the next wave of change across nearly every telematics use case. By partnering with leading connected-vehicle data companies, like Motorq, which integrates real-time data from nine of the ten largest OEMs, insurers could capitalize on this shift to software and vehicle data, unearth novel risk factors, and unlock new revenue streams.

Where it started

A Google search of the term “vehicle telematics” will generate myriad definitions that vary across use cases and settings, from parking to tolling to insurance. At its foundation, however, the core definition of telematics is simply technology that enables the monitoring and management of vehicles.

The telematics industry rose to prominence in the 1980s with the development of the OBD port in vehicles. Spurred by a need to regulate tailpipe emissions, state and federal regulators began to mandate the inclusion of the OBD port on every gasoline-powered vehicle operating in the United States. As a result of this ubiquitous deployment, the port also became a popular way to access other datasets within the vehicle, from geolocation to speedometer to usage patterns via plug-in dongles. These datasets would serve as the foundation for fleets to manage their vehicles more effectively and ultimately drive improvements in their core businesses. Over the next two decades, several emerging telematics providers leveraged these dongles to collect and transmit data via cellular networks. Many of these businesses would become the large incumbents we know today, including Geotab and, more recently, Verizon Connect, acquiring Telogis for $900M and Fleetmatics for $2.4B.

Where we are today

Over the last decade, however, the telematics industry has begun to shift dramatically, driven by the mass adoption of smartphones. The industry has migrated toward smartphone-first solutions, which solved critical challenges associated with dongle-based devices; the most important of which was cost. OBD and device-based solutions suffer from significant upfront costs associated with the hardware purchase, inventorying, installation, and fleet downtime, which could generally be eliminated with a mobile app-based solution.

Simultaneously, telematics solutions have also matured substantially toward industry-specific use cases, which tend to have their own nuanced set of requirements. Video-driven analytics, for example, has become increasingly popular with trucking fleets, with companies such as Samsara and Lytx creating dedicated solutions for this space. Similarly, within insurance, the need to correlate driver-behavior data with actuarial loss scoring and ratings has given rise to telematics platform vendors like The Floow, Cambridge Mobile Telematics (CMT), and Arity.

Yet despite all the advancements within the industry, telematics adoption remains at low levels, with only 10-15% of fleet vehicles leveraging telematics today. This low adoption rate is a direct result of the numerous challenges and drawbacks associated with both device-based and smartphone-based solutions. OBD plug-in devices, for example, not only suffer from high upfront costs but also provide access only to a small subset of vehicle data. In fact, only 10% of data on the vehicle can be accessed through the OBD port. Moreover, the quality of this data often varies across vehicle models and makes, creating challenges in deriving operational insights for decision making. Finally, the future of the OBD port itself remains in question with the shift toward electric vehicles (EVs), where there is no emissions-driven regulatory requirement to include the port within the vehicle. The Tesla Model 3, for example, does not have one. Similar challenges can be seen within mobile-first solutions, which solve the upfront cost challenges associated with hardware but offer lower levels of accuracy and more limited data sets relative to vehicle-originated data.

Connected vehicles and the future of telematics

In 2011, Marc Andreessen of a16z famously penned an article announcing that “software is eating the world.” Vehicles are no exception, and we expect to witness a sea change in how vehicles will be managed over the next decade – more specifically, a migration toward telematics powered by software-only connected-vehicle data.

Foundationally, both smartphone- and device-based solutions attempt to solve the core challenge of extracting data around how a vehicle is used and operated. This, however, is solved much more elegantly with connected vehicles. Since 2018, nearly every new vehicle has been equipped with in-cabin connectivity, with the car itself having the ability to both transmit and receive data. This level of native connectivity offers higher quality, breadth, and accuracy of data relative to both mobile and device-based solutions while simultaneously eliminating the upfront costs associated with additional hardware and installation.

There are, however, two main challenges with leveraging connected-vehicle data that have been solved only in recent years. The first is that OEMs have largely been reluctant to open up access to vehicle datasets due to privacy, security, and competition concerns. The second challenge is the lack of clean, normalized data to enable easy consumption as data formats, availability and even definitions vary based on vehicle make and model. Ultimately, the market needs an integrated infrastructure solution that can not only unlock vehicle data access across OEMs, but also provide clean normalized data and insights that are easily ingestible via API. Motorq, an Avanta Ventures portfolio company, currently integrates with nine of the ten largest OEMs, providing nearly 100% coverage of new vehicles sold in the past four to five years. Leveraging these integrations, Motorq provides normalized connected-vehicle data and value-added analytics that enable numerous commercial use cases, from fleet management to fuel cards to insurance.

The future of insurance telematics

Insurance telematics has already begun to move toward connected-vehicle data from purely mobile-based solutions, such as CMT and Arity. This transition, however, will likely occur in two phases, beginning with commercial and followed by personal lines products, driven by varying customer needs and use cases that are significantly different between commercial and personal lines.

Insurance telematics has already begun to move toward connected-vehicle data from purely mobile-based solutions, such as CMT and Arity. This transition, however, will likely occur in two phases, beginning with commercial and followed by personal lines products, driven by varying customer needs and use cases that are significantly different between commercial and personal lines.

There is a strong need for operational efficiency and effective risk management within commercial fleets, which will likely lead to insurance becoming increasingly embedded into a broader fleet management and risk solution. With vehicle-data-powered fleet management platforms gaining market share over the next five years, fleet managers are likely to turn toward insurance options that can leverage such data for better pricing and safety management, versus deploying an entirely new device or mobile platform-specific to insurance and introducing yet another workflow that requires management. As a result, we expect to see increasing partnerships between fleet management companies (FMCs) and insurance carriers over the next five years. Currently working with seven of the ten largest FMCs, Motorq is quickly becoming the standard, white-labeled vehicle data-management infrastructure that powers the FMCs’ next-generation cloud platforms. Additionally, Motorq has begun working with a top-five insurer to pilot a vehicle data-driven telematics solution for commercial vehicles.

Personal lines will likely follow commercial insurance in connected-vehicle data-powered telematics, particularly as insurers have already made significant investments in smartphone-focused solutions like CMT, Arity, and Zendrive. Additionally, the personal lines consumer use case also tends to focus exclusively on insurance cost savings, compared to a commercial fleet’s added focus on operational efficiency. Ultimately, the shift toward vehicle-data telematics for personal lines will likely be ignited as novel risk metrics that would not be possible with smartphone-based telematics are discovered and correlated with losses. The insurers leveraging such vehicle data sets would be able to price more accurately, translating into more competitive premiums for the safest customers.