This article “Measuring and disclosing emissions for the insurance industry” was contributed by Deepak Mishra, Avanta Ventures Senior Associate

The Paris Agreement’s goal to significantly reduce the world’s carbon footprint by 2050 has substantially increased the global focus on greenhouse gas emissions. Recent changes in regulatory disclosures, current policies (2022 Inflation Reduction Act) and the increase in catastrophic events due to climate change have accelerated the need for action.

A new wave of emissions tracking and reduction platforms has emerged to meet growing demand from investors, corporations, and governments as the pressure to reduce carbon footprints and combat climate change mounts. CSAA for example, has committed to achieving a 50% carbon emissions reduction and carbon neutrality by 2025. CSAA published its second annual Environmental, Social & Governance (ESG) report and invested in Wildfire Innovation Fund, which speaks to CSAA’s commitment to addressing the rising climate risk and meeting emissions goals.

The market trends and opportunities

Global greenhouse gas emissions in 2022 were 57.8 gigatons (GT), of which the United States comprised 6.2 GT (11%). Emissions must come down by about 3 GT yearly to achieve the net-zero goals, but the 2021 and 2022 targets have already been missed. A study by kWh Analytics suggests that with no intervention, global greenhouse gas emissions will rise to more than 150 GT annually by 2100, hiking the global temperature up by 4.1-4.8 degrees Celsius, which exceeds the United Nations (UN) goal of 1.5 degrees Celsius. There has been rising customer demand for low-carbon alternatives, lower-cost remediation, accountability and potential litigation for the biggest offenders. As a critical enabler for all industries, insurance is exposed to climate-related liabilities (physical and transition risks) on two fronts of a balance sheet: investments on the asset side and through property and casualty underwriting risk on the liability side.

Measuring emissions is big business and will only grow as the framework and guidelines from Task Force on Climate-related Financial Disclosures (TCFD) and the Securities and Exchange Commission (SEC) are adopted. Financial institutions alone are expected to spend $256M between 2021-2027, up from $51M in 2021, in the carbon reporting market alone. The market is expected to grow from $880M in 2021 to $4B in 2027 at a compound annual growth rate (CAGR) of 30%. The market growth is driven by innovation in advanced tools, incentives, and high-resolution data sources from several sources, such as satellites and sensors.

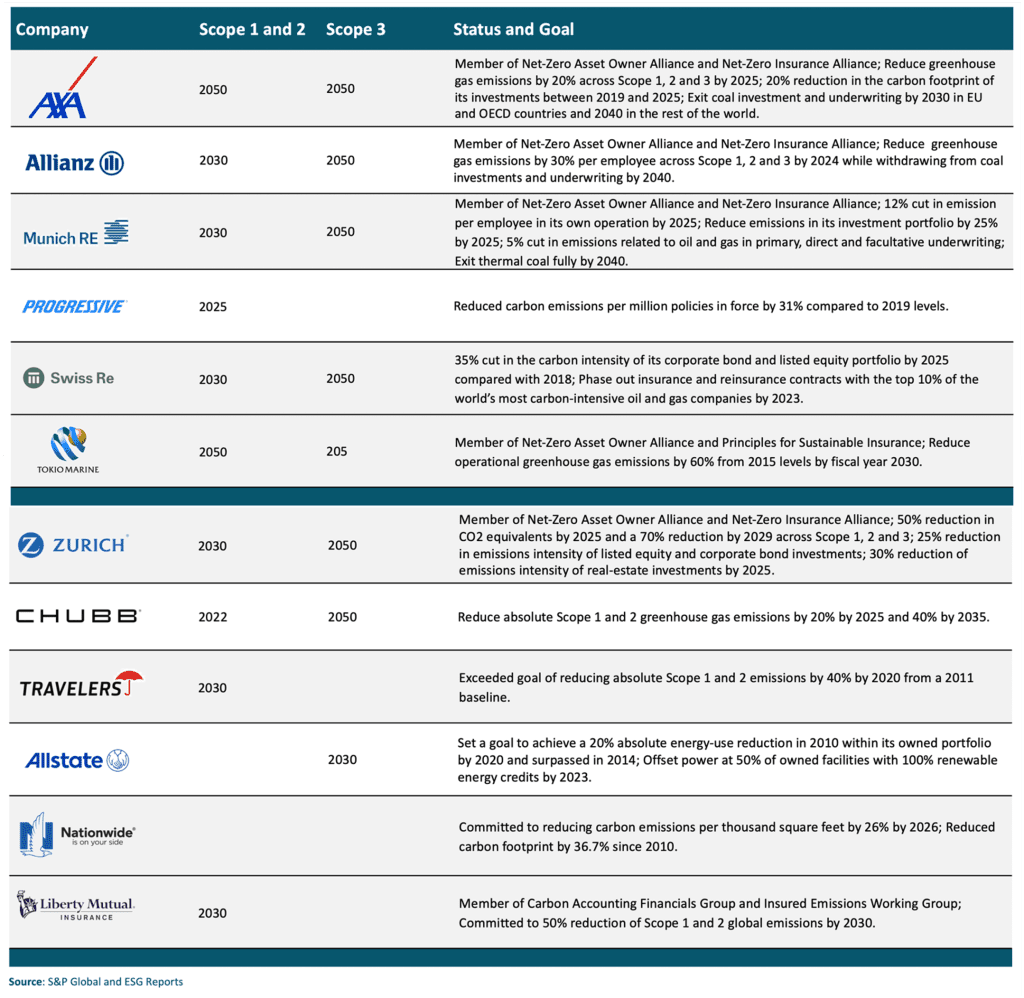

Select Insurers’ and Reinsurers’ Emissions Target Goals

Several carriers have been taking steps to disclose and analyze their emissions in the insurance industry. However, many publicly-traded insurers are waiting for specific guidance from the SEC on emissions disclosure requirements. Allianz has disclosed its emissions for the past few years and reported 138,746 metric tons in 2021, almost 100,000 metric tons less than in 2020. Other insurers, like Liberty Mutual Insurance and Allstate, have fewer than 100,000 metric tons of emissions. Emissions linked to auto and property insurance claims alone are estimated to be about 1% of global emissions, especially vehicle and property repairs arising from claims settlements. Most insurers disclose Scope 1 and 2 emissions, which are direct and indirect emissions from their operations. However, they often don’t include a full range of the Scope 3 indirect emissions that typically result from the value chain across underwriting, claims and investments, which are more than 90% of an insurer’s emissions output.

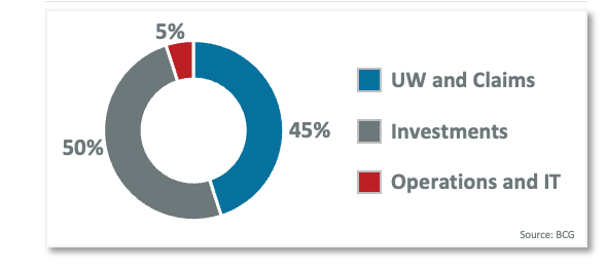

Average Insurers Carbon Footprint Profile

Several (re) insurers have recently disclosed their emissions goals and status. Allstate is committed to becoming net-zero for all direct, indirect, and value-chain emissions by 2030 – 20 years sooner than the 2050 target set in the Paris Agreement. AXA is also a category leader in this space. The sheer number of ways it cuts its investment data is impressive.

Emissions Goals and Status of Several Insurers

Emerging ecosystem of climate risk and emissions platform startups

Innovative startups are addressing the needs of insurers to measure and remediate their emissions. By partnering with companies focused on these areas, insurers can address their carbon footprint across investments, underwriting, and claims; efficiently manage and mitigate catastrophic weather events; and strengthen their underwriting models.

Climate risk management and analytics

The Financial Stability Board (FSB) created the Task Force on Climate-Related Financial Disclosures (TCFD) to develop recommendations on the types of information that companies should disclose to support investors, lenders, and insurance underwriters in appropriately assessing and pricing a specific set of risks – risks related to climate change. The TCFD found in its 2018 Status Report that only a few companies disclose the financial impact of climate change on their operations or business model. Insurers’ adoption of TCFD reporting helps them better prepare for climate change impacts on their business and policyholders.

Companies like One Concern, Tomorrow.io, ClimateAI, and Cervest have built software platforms to predict, measure, and specify climate-related risks for any asset, including physical property and renewables. Often the insights from these platforms – along with machine learning models from satellite imagery, stationary sensors, IoT devices, radar, and sonar – are applied to underwrite and monitor policies for a wide range of weather events such as floods, fire, precipitation, and others. Several insurers, such as AXA XL, announced that they launched the Coastal Risk Index tool, which maps flood hazards resulting from climate change and integrates the protective benefits of coastal ecosystems into insurance risk models. Avanta Ventures has invested in companies like Kin, Cape Analytics, and Delos in climate and catastrophe-prone risk selection and mitigation.

Emissions tracking and reduction startups

Financial regulators, including the SEC, are beginning to formulate new disclosure requirements for climate risks. Still, many corporations lack accurate and comprehensive ways to measure and disclose their emissions exposure. Startups like Persefoni, Claims Carbon, Kita, CarbonChain, Measurbl, Jupiter, and Arcadia are helping large enterprises, including insurers, get a clearer view of their carbon footprints (including in underwriting, claims, and their investments of surplus). Some of these startups can calculate emissions on a real-time basis. Other startups, such as Patch, Watershed, and Sinai, offer decarbonization platforms that promise emissions reduction for various industries.

Insurers partnering with startups to reduce emissions and meet their net-zero goal is also a growing trend. To improve and increase reporting of climate-related financial information, insurers like MS&AD Insurance and QBE have partnered with Jupiter to conduct climate-change impact assessment services for financial disclosures. Swiss Re and Carbonfuture signed a multi-year agreement to support high-quality standards in the biochar carbon-removal market. Zurich signed a carbon-removal deal with Climeworks. AXA Investment Management also recently bought a carbon-offsetting platform, Climateseed, which connects businesses seeking to offset their carbon emissions with project developers. Tokio Marine partnered with CarbonChain to measure customers’ emissions and compare them with the industry to develop a carbon risk rating for its customers, which will be factored into underwriting.

Implications for insurance companies

Many insurers are committed to reducing their greenhouse gas emissions and offsetting the remainder through contributions to reforestation and renewable energy projects. They also plan on offering “green” insurance products. As startup development of climate-risk management and emissions tracking and measurement platforms grows, partnership opportunities to meet those commitments are emerging for insurers through commercial engagement, investments, or acquisitions. Specifically, partnerships with startups could unlock emissions-informed underwriting and pricing advantages, support the achievement of net-zero goals, and support new green product development.

Ultimately, the shift toward leveraging new platforms to better disclose and reduce Scope 3 emissions will create opportunities for insurers like to efficiently measure their underwriting, claims and investments emissions and offer new green insurance products.