Proptech is the application of innovative information technology and platform economics to real estate markets. Proptech startups are offering new products addressing frictions in the traditional real estate market and attracting a growing proportion of new property owners, managers, and renters. This market disruption creates an opportunity for insurers to consider embedded insurance distribution, joint marketing, or other go-to-market partnerships with Proptech startups to broaden and diversify insurers’ customer acquisition reach.

A relevant residential Proptech market segment provides financial, real estate purchase, and rental assistance via new, innovative platforms. Cash guarantee startups have democratized access to homeownership by enabling people to become cash-offer buyers. Rent advance and rent guarantee startups empower landlords with early and/or specific access to rent funds. These startups often use these cash access services to sell related products, such as insurance. These Proptech startups can enable insurance companies to connect with prospective customers when they may be open to making or revisiting insurance purchase decisions.

Market overview

Proptech is estimated to be an $18.2B market in the US in 2022, growing at a CAGR of 16.8%. Commercial and residential use cases provide some division in the market, but many startups deliver solutions for both segments.

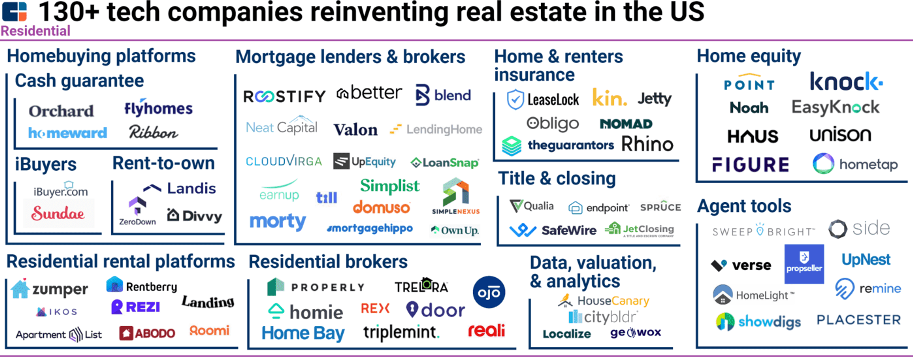

The following CB Insights market map illustrates the residential Proptech market segment. There are several distinct user communities on the residential side, including owners, tenants, landlords, investors, and builders. Solutions for one of these user communities often present opportunities to sell to and/or partner with associated communities. For example, startups such as Jetty partner with property managers to make their renter’s insurance and other products available to tenants and then charge them.

Extension across related products and services is standard amongst Proptech startups. Obie, for example, provides its property management platform for free and makes money from the insurance it sells to real estate investors and landlords. Home buying platforms enabling cash offers, may also be brokerages with buying and selling agents. They may even own title, mortgage, and real estate investment companies.

Rent-to-own startups, such as Divvy and Landis, extend a cash guarantee model into a longer-term relationship. Cash guarantee startups typically have a maximum of six months between when the startup buys the home with cash and when the buyer must purchase the home from the startup. These rent-to-own startups also offer up to three years after they’ve purchased the home for the buyer to live in the house and pay rent to the startup. The buyer is expected to buy the home from the startup by the end of the three years.

Finally, startups with co-ownership models, such as Home LLC, provide part of the home’s down payment. The startup then takes a percentage of the appreciation of the house when it is sold or refinanced.

Cash guarantee startups

Orchard

Orchard offers loans to enable people to make cash offers for home purchases, buy new homes before they sell their existing homes, and sell their homes with the comfort of a guarantee that they will be purchased within six months. In September 2021, Orchard announced their venture capital raise of $100M at a $1B valuation.

Flyhomes

Flyhomes allow people to buy homes via cash offers, buy new homes before they sell their current homes, and have guaranteed home sales. In June 2021, Flyhomes announced that they raised $150M in Series C funding at an $800M valuation.

Homeward

Homeward trains and certifies real estate agents to acquire customers for their cash guarantee services. They enable cash offers, the purchase of new homes before the sale of users’ existing homes, and the guaranteed sales of homes. In April 2022, Homeward announced that it raised $371M.

Ribbon

Ribbon extends its cash guarantee services to include offering boosted cash offers that may exceed appraisals, “closing rescue” options that allow them to step into transactions that are already under contract, and options for users to pay for their services from a portion of the home’s future appreciation. At its core, Ribbon provides services that help people to make cash offers, buy new homes before they sell their existing homes, and rely on guaranteed home sales. In September 2021, Ribbon announced that it raised $150M.

How cash guarantees work

Cash guarantee usage generally falls into a small number of categories.

- Buying independent of selling

- Cash Offer: The startup will buy the home with cash. The buyer will then secure a mortgage to buy the house from the startup. Startups frequently allow up to 6 months for the mortgage transaction to be completed. The buyer will pay rent to the startup until the transaction is completed. The startup often acts as the buying agent for cash offers and receives the buyer’s agent fee. Some startups, such as Ribbon, may work with buyers’ agents to acquire customers and may charge the customer. Many of these startups aim to be the agent on both sides of the transaction. For example, Orchard owns homes that it offers to its users.

- Cash backing: The startup guarantees that the purchase will close. This allows the removal of certain contingencies from the buying process. The startup only steps in to purchase the home with cash if the buyer cannot complete the closing without the startup cash. The startup may act as the buying agent in the latter case. The fee is generally lower for this service than for the Cash Offer service. When Orchard acts as the buyer’s agent, they do not charge for cash backing. Ribbon charges a non-refundable 1% home sale price for cash backing. Then, they charge the remainder of their cash offer fee if they need to step in and buy the home. This service effectively behaves as if it were “closing insurance.”

- Cash boost: Cash boost services enable the buyer to make offers for amounts higher than the Cash Offer service allows. Buyers may use this if there is an actual or expected appraisal gap. Cash boosts may be very expensive for the buyer. For example, Ribbon charges $250 per $1,000 of cash boost if the buyer pays the fee at closing. This startup charges 25% of the home price appreciation if the buyer prefers to pay the cash boost fee in the future at the time of the sale, cash-out refinance, or a date of their choosing. In the case of future fee payments, the total payment is capped at 3x the original appraisal gap amount. However, this cap cannot distract from the predatory nature of this fee structure.

- Buying before selling

- This service enables homeowners to buy a new home before selling their current home. This effectively combines buying and selling services. The startup will buy the new home and rent the new home to the buyer until the existing home is sold. The startup guarantees the sale of the existing home. Homeward, as an example, charges 1.4% if the buyer also uses Homeward for the mortgage. Otherwise, the buyer may pay 1.9% or 2.4%, depending on the home’s state.

How cash guarantee startups compete

Similar startups, different locations: Many of the cash guarantee-related startups are remarkably similar. Their fees and service offerings may be nearly identical. The startups have shown a tendency to operate in different locations. However, specific states have been exceptionally attractive for cash guarantee-related startups (e.g., Colorado, Georgia, Oregon, Texas, and Washington), which is not surprising given that these states have the highest median home prices.

Agent engagement: Many of these startups engage real estate agents to increase their access to customers. For example, Homeward invites agents to become “Homeward Certified Agents.” Agent programs, including FlyHomes’ program, often allow the agents to keep their commission due to the startup earning revenue from other parts of the transaction (e.g., the mortgage or a convenience fee charged to the buyer). Orchard is distinguished by its approach of being a broker with in-house real estate agents who are full-time Orchard employees.

Extending across the value chain: These startups frequently participate in multiple stages of real estate transactions via their subsidiaries and affiliates. Vertical integration and product expansion allow them to discount certain parts of real estate transactions because they can make money on others.

What does this mean for insurers?

In Proptech, alternative home financing-related startups offer insurers opportunities for customer acquisition and a better understanding of home buyers and landlords. Qualifying purchasers for cash access-related services, such as cash offer guarantees for buyers and rent guarantees for landlords, produces lead generation opportunities and relevant targeting data for insurers. Furthermore, these startups’ extensions across the real estate transaction value chain and agent engagement models can offer valuable insight if insurance companies consider non-risk-bearing business expansion.