The COVID-19 pandemic has resulted in tectonic shifts in consumer behavior and the meteoric rise of e-commerce and all things digital. This is having significant second order and long-term impacts on the broader mobility industry. Increasing strain on mobility supply chains, highlighting the need for last-mile delivery management efficiencies, and accelerating autonomous vehicle innovation.

Second order effects and flipping the script

In March 2017, Benedict Evans, a General Partner at Andreesen Horowitz, published, “Cars and Second Order Consequences” he postulated that the second order effects of introducing autonomous vehicles (AVs) would produce dramatic changes on our society that go beyond reducing accidents or eliminating gas stations. In his words, “it was easy to predict mass car ownership but hard to predict Walmart… I can’t tell you what will happen to car repairs, commercial real-estate or buses but I can suggest that something [big] will happen.”

While AVs will disrupt many industries in the future, what’s clearly disrupting every industry today is COVID-19. The virus’s driven disruptions in consumer retail will have significant second order impacts on mobility.

The rise of e-commerce and changing consumer behavior

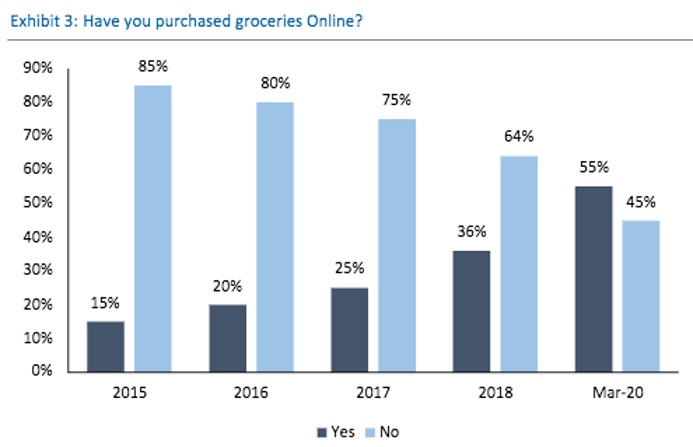

As social distancing continues amidst fears of contracting COVID-19, people are increasingly turning to e-commerce and home delivery as the solution. Amazon has been the dominant benefactor, announcing to hire 33,000 new employees in September on top of their 100,000 employees hired in March alone to meet increased demand, as estimates indicate 35% increases in year-over-year consumer spending on the platform. We believe; however, the rise of e-commerce is indicative of a paradigm shift and retraining of consumer behavior. Online grocery delivery is the epitome of this shift. A recent 1,500-person survey conducted by RBC Capital Markets in late March revealed a sharp increase in the percent of people who are switching to online grocery shopping.

Even more notable, however, is that one-third of people who answered yes to the question, “have you purchased groceries online” also said their first time doing so was the week prior. Of those who hadn’t yet shopped for groceries online, 41% said they intended to do so imminently. Online grocery shopping is a prime example of how this crisis has forced consumers to shop online for goods that they were only once comfortable purchasing in stores. As this shift to online purchasing becomes permanent, there will be an increasing need for delivery to the home for which, unlike Amazon, most retailers are ill-equipped. They will have to either hire their own drivers, create their own fleets, or contract with third parties for delivery to the home.

Implications for brick and mortar retail and how it’s affecting the insurance industry

At the same time that Amazon is rapidly scaling up its distribution centers, Macy’s has furloughed over 125,000 employees with over 190,000 retail stores temporarily (and possibly permanently) closed across retail altogether. While this COVID-19 crisis will eventually fade from the headlines, the shift away from brick and mortar retail to e-commerce will likely have permanent effects. Many department stores who were already facing increasing financial challenges prior to the onset of COVID-19, are or will file for bankruptcy. In fact, the post-COVID-19 brick and mortar picture may feature retailers who offer consumers either experiential products that are difficult to trial online, operate more as showrooms or cater toward services.

As these businesses generally require less physical footprint to deliver their services, we will begin to see new models of serving the end consumer that could mirror that of the “delivered to my front door” convenience of e-commerce. Concepts like Toyota’s e-Palette modular shuttle, where autonomous vehicles are leveraged for various use cases for example, could see accelerated development as a result.

Toyota e-Palette mixed use, modular autonomous shuttles

For insurers such concepts introduce both new risks and opportunities. As both the vehicle cabin becomes configurable to serve a variety of retail use cases and the “driver” becomes autonomous, there will be profound shifts in the way we insure these vehicles. There are numerous startups emerging to solve and address various pieces of this puzzle. Companies like May Mobility are building such autonomous fixed route shuttles and working with large enterprises to transport employees to and from public transit stops. Others like Mpathy.ai and Passenger.ai are leveraging artificial intelligence (AI) and computer vision to monitor in-cabin behaviors, alerting shared mobility operators in events such as smoking, forgotten items, etc. Still, others such as Edge Case Research and Avanta Studios’ company, Ottometric, are leveraging tools to detect edge behavior cases to better train the vehicle’s AV system. Each of these categories represent potential opportunities to help insurers prepare for a changing automotive and retail future.

Implications for supply chains and how it’s affecting the insurance industry

In the same way that it is changing brick-and-mortar retail, COVID-19 is also impacting and placing immense strain on every part of the supply chain. Even prior to the COVID-19 crisis, the US was facing a shortage of over sixty thousand truck drivers. These numbers will only increase as e-commerce activity swells. Even more pressing than long-haul trucking is last-mile delivery, which represents over 50% of the total delivery costs. These costs are a direct result of the inefficiencies and challenges generated in last-mile delivery: from the human element of door-to-door drop-offs to constantly changing delivery routes to the limited density of delivery locations in suburban locations.

As a result of these challenges and the pressing need to increase efficiency and lower costs, fleets will be required to seek out new solutions and opportunities. Fleets will increasingly require advanced management capabilities to improve vehicle uptime via predictive maintenance, to increase overall efficiency via dynamic routing and to lower accidents via driver monitoring. Moreover, all of these applications will require high-quality in vehicle data and telematics solutions: an area that will become increasingly critical. Companies like HDVI, for example, are creating insurance products with driver behavior coaching as a key component aimed to help long haul truck operators improve how they drive and reduce accidents. Others such as Wise Systems are leveraging AI to improve the efficiency of routes for last-mile delivery. Finally, companies such as Motorq are acting as the bridge to enable fleets to access in-vehicle data without the need for additional hardware. Each of these three examples represents both opportunities for fleets to improve their own operations through data and telematics, but also partnership opportunities for insurers to unlock new channels.

The future of mobility and insurance continues to evolve as we face new challenges that come with COVID-19. This shift has affected e-commerce and the way we consume products with AI-assisted delivery services. As we continue tracking these changes, we can’t help but wonder how e-commerce and the insurance industry will be impacted in a post-pandemic world.