FinTech is a term to describe new technology that improves and automates the delivery and use of financial services. FinTech provides paths for engaging prospective insurance customers at purchase decision points, understanding evolving customer intent, increasing customers’ immediate and long-term purchasing capacity, increasing the set of owned assets that customers need to protect, and delivering efficient claims payments that increase customer satisfaction and retention.

As venture capital firm Andreessen Horowitz notes, FinTech previously meant selling technology to large banks. Today, it means going full-stack by offering end-to-end customer service, participating in more parts of the value chain, and building better and more inclusive experiences. Banks and other legacy financial service providers are being disintermediated and replaced by FinTech companies that serve the customer at the point of need. Financial services such as insurance, lending, and payments have been shifting from stand-alone experiences to being seamlessly embedded within consumers’ activities at the point of sale.

For insurers, FinTech opens new opportunities for dynamic and personalized customer value propositions, lower customer acquisition costs, and higher customer lifetime values. Buy Now, Pay Later (BNPL) technology is one example of new FinTech products that insurers are leveraging to connect with customers who see BNPL’s finite installments, easier credit approvals, and zero-interest options as a path to expanded purchasing capacity.

FinTech market size and key segments

According to CB Insights, FinTech funding in the U.S. and globally reached all-time highs. U.S. FinTech funding grew 171% year-over-year (YoY) from $23B in 2020 to $63B in 2021 while global FinTech funding grew from $49B in 2020 to $132B in 2021. This rapid growth outpaced global and U.S. venture capital investment, which grew by 111% YoY and 106% YoY, respectively. While global InsurTech funding grew from 2020 to 2021 by 90%, InsurTech funding only comprised approximately 12% of the total global FinTech funding in 2021 at $15.4B.

FinTech segmentation

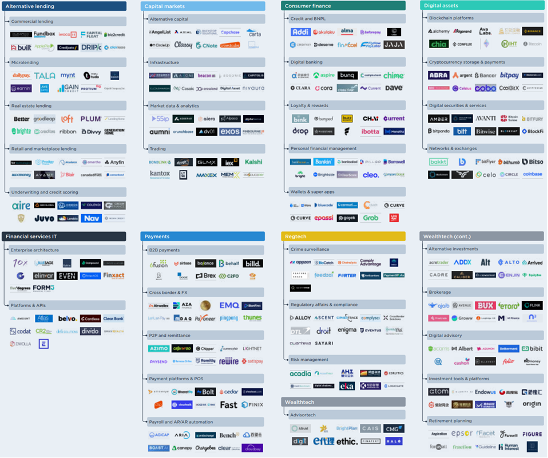

PitchBook’s market map provides a useful framework for segmenting the broader FinTech space:

- Alternative lending includes student loans, mortgages, commercial and retail lending, and the underwriting and credit scoring that enable lending.

- Capital Markets has stock market investing and trading as well as market data and analytics that support investment decisions.

- Consumer Finance contains digital banking, loyalty and rewards programs, and consumer credit, such as credit cards.

- Digital Assets cover cryptocurrency transactions, storage, and networks.

- Financial Services IT provides enterprise architecture, cloud services, platforms, and APIs.

- Payments include B2B payments, P2P, remittance, non-bank transfers, digital-only banking, payroll, AP/AR automation, and point-of-sale systems. According to McKinsey & Company, almost one in two consumers now use a payments FinTech solution.

- RegTech consists of crime surveillance, fraud detection, risk management, regulatory affairs, and compliance to drive loss prevention and recovery.

- WealthTech consists of digital advisory tools and platforms that aim to preserve and grow wealth.

While some consider InsurTech to be a subset of FinTech, PitchBook, and others advocate that InsurTech has matured enough to be considered a separate and distinct sector.

Buy now, pay later (BNPL)

“Isn’t BNPL just lay-a-way / installment payments / what credit cards are for?” Some form of BNPL has been in use for decades. Installment plans and credit cards allow buyers to pay over time. Payment in advance, COD (cash on delivery), and payment over time widened the pool of potential buyers. Now, BNPL and associated real-time credit underwriting models have made it easier and more common for purchase financing decisions to move earlier in the value chain, to the point of purchase. Venture capitalists are betting heavily that BNPL startups can disrupt the $8T credit card market. According to CB Insights, venture capital funding for BNPL has grown at a 93% compound annual growth rate (CAGR) since 2016 to $1.465B in 2020.

When Affirm, a leading BNPL provider, started in 2012, BNPL was not the buzzword that it is today. Two major factors drove its growth:

- Millennials have grown both their purchasing power and debt capacity. Those born between 1981 and 1996 are now between 26 and 41 years old. They have purchasing power and interest in higher-cost electronics and other expensive goods. They have existing debt that makes the opportunity to avoid interest attractive. They may have limited or imperfect credit histories that make easier credit approval on BNPL, an enabler.

- The pandemic created a long-term, seismic shift in buying habits. Being abruptly and unexpectedly constrained to their homes in early 2020 made people go from thinking about purchasing home exercise equipment and similar home additions to buying them. BNPL enabled those unplanned purchases to fit into budgets.

While the pandemic reduced incomes for many people, it increased the available income for purchases for other people. People who were suddenly not spending as much as they usually did on travel, gas, grooming services, etc., could now direct additional funds toward other purchases. The shift of shopping from in-store to online empowered the online checkout process. BNPL providers’ checkout integrations gave them an advantaged position for connecting with customers.

BNPL: Transformation in progress

Americans made an estimated $20B-$25B worth of BNPL purchases in 2020. The global BNPL revenue opportunity is valued at $680M today, with the potential to be a $1.1B market by 2025. An ecosystem has started to form around the recent interest in BNPL extending into various industries, including warranty and insurance. Ribbit Capital, a leading FinTech VC, has partnered with Walmart to launch next-generation digital financial products. White-label BNPL platforms have enabled banks to make their own BNPL products to diversify their loan portfolios, such as GreenSky, which provides a white-label BNPL offering to partners such as Fifth Third Bank.

It will be important for those considering implementing BNPL to remain up to date about BNPL’s regulatory environment as regulators recognize that as purchases become easier for consumers, so does overextension into debt. In the announcement of its recently opened inquiry regarding BNPL, the Consumer Financial Protection Bureau raised concerns about accumulating debt, regulatory arbitrage, and data harvesting.

Some believe that BNPL consumers’ lack of attention to the potential impact of BNPL on their credit scores is forming a new bubble whose eventual burst could eclipse that of the housing bubble crisis. In December 2021, Equifax became the first credit reporting agency to formalize a standard process for reporting BNPL tradelines for inclusion on traditional consumer credit reports. Transunion is now working on a BNPL credit reporting service as well.

What insurers are doing

While P&C insurers may not have started labeling their activities as BNPL yet, many have offered something that resembles BNPL for years via installment plans and/or accepting credit cards for premium payments. More recently, certain insurers have made their products available on other companies’ BNPL stores or published content that demonstrates their awareness of BNPL.

In addition to dipping their toes in the BNPL space, insurers have also embedded their products within the purchase process for protectable products (e.g., warranties) and expanding digital payments capabilities. Select examples include:

- Allstate, Farmers, and GEICO products are available in Zip.co. This store allows consumers to buy from its partners in four installments over six weeks.

- Allstate Protection Plans Express enables brick and mortar and e-commerce brands to offer warranty products via an API. Allstate acquired SquareTrade for $1.4B as the basis of this product line.

- AmFam partnered with Fiserv to enable customers to pay premiums in cash via Fiserv’s more than 30,000 CheckFreePay

- State Farm partnered with Fiserv to offer a digital payout for claims. Customers can receive their claims payments to a debit card or bank account.

What this means for the future

Embedding insurance into more parts of the value chain through BNPL integrations can introduce lower customer-acquisition-cost (CAC) opportunities to reach the high lifetime value (LTV) audiences BNPL attracts, such as young adults.

Also, like robots, vehicles and connected homes become empowered to initiate and complete financial transactions on their own, FinTech will extend deeply into any market with connected devices, including vehicles. For example, Blackberry is embedding Car IQ’s (an Avanta Ventures portfolio company) vehicle-initiated payment platform into its QNX connected-vehicle operating system, which already has an installed base of more than 195 million vehicles. Car IQ’s early adopter commercial fleet customers have begun trialing paying for fuel autonomously at the 15,000 Shell stations on the platform, without the need for a human to swipe a credit card.